I don’t know about you, but I have always had trouble with the desire to impulse spend. I struggle to keep that impulse under control and stop buying stuff. There are some moments when I have extremely good willpower and can keep my spending to a minimum, like for instance when I was planning my wedding and had a passionate financial goal, but for the most part, the ability to stop buying stuff and control the impulse has always been a struggle for me.

Why you should stop buying stuff

Buying stuff has several implications. Everything you purchase is then entering your life. In some manner, you have to give it your time and energy in a way that never would have existed before it was bought. It has to be used, eaten, stored, fixed, looked at, cleaned, or any other manner of things that require something from you. So in addition to the time spent searching and purchasing for the object, it then requires more from you after it enters your home.

In addition, there is the financial burden of buying stuff. Every item that is purchased is less money in the bank. A $5 coffee three times a week becomes $780 over the course of a year. It’s easy to stop and think about a $1,000 or even a $100 expense, but it’s the $10, $25, $50 expenses that we don’t bat an eye about that over the course of a year can add up to more than a thousand dollars, before interest. If we want to save money and hit our financial goals, we need learn how to stop buying unnecessary stuff.

Impulse Spending and Habits

Some time ago I read the book “The Power of Habit” by Charles Duhigg, which is an incredibly enlightening read. In his book, Duhigg goes into detail about exactly how habits work. Habits, or the action that is performed through the habit, happens after your brain receives some external trigger. After the action of the habit is performed, your brain receives a reward.

For example, getting out of bed in the morning can trigger your brain to start the action of making coffee, and the reward is having a hot cup of coffee. Sitting down on the couch can trigger looking at your phone, and seeing a new message or notification is the reward. Similarly, looking at your phone may trigger the habit of opening up the Target app, and the reward is having made a purchase. Habits live and breathe with instant gratification. Understanding how they work is the first step to breaking them.

Our seemingly uncontrollable desire to shop and spend money stems around habits. Impulse buying and our inability to stop buying stuff can be simply boiled down into our habits. Unfortunately, habits can be extremely difficult to break. Instead, they are far easier (but still not easy) to change.

The Ultimate List of Ways to Stop Buying Stuff

I’ve created a list of several different ways to stop, modify, or break up the habit cycle that revolves around impulse spending, to help stop buying stuff you can’t afford once and for all.

Alter the reward of the habit.

Your brain receives a trigger, and after it performs the act of purchasing, it expects some reward. Here the goal is to trick your brain into thinking it’s receiving the reward, because what you’re giving it is such a good alternative to what it is used to. Stuff like this works extremely well if your brain likes to trick you into thinking you’ll forget about it if you don’t purchase immediately. I’ve listed a few ways you might accomplish this:

- Save the item to a Pinterest board

- Take a picture

- Make a wish list and write it down.

Track your spending.

By tracking your spending, you can see exactly how much money you are spending on impulse purchases. Understanding exactly how much you are spending can increase the desire to stop buying stuff. There are several apps that allow you to track your spending, including You Need a Budget, Mint, and others. In addition, you can use paper or computer spreadsheets. Remember though, tracking spending that’s happened in the past, is different than making a budget which forecasts the future.

Make buying stuff difficult.

There are several ways our brains work on autopilot to complete a purchase and we don’t even realize it. Taking a few simple steps now can make it harder to buy stuff in the future, which alters the action of the habit, and makes it less desirable.

- Delete shopping apps like Target, Walmart, and Amazon from your phone. If you do a lot of shopping on Facebook Marketplace, try deleting Facebook from your phone too (you might get the added benefit of wasting less time on your phone too!)

- Unsubscribe from e-mails and sales. If your trigger is seeing a sale, remove the ability to easily find sales by unsubscribing from store emails. This also has the added benefit of less digital clutter in your life.

- Remove credit card information from websites. Target and Amazon, and several other websites, make it so easy to purchase by saving your credit card information. Remove the information so that every time you want to buy you have to get up, go get your wallet, and type all your information in before you can complete the purchase. That in itself can be a big deterrent. If you are forced to save information, either delete it as soon as the purchase is complete, or use a card associated with an account that doesn’t have a lot of money in it. For example, my Target RedCard barely has more than $100 at any given time. If I want to buy something from Target, I have to make the conscious effort to transfer money into that account before I make the purchase.

- If you are more prone to shopping in person, cut up credit cards or hide them in the freezer to make them less desirable to use.

Recognize the trigger and change the action.

If you can recognize the trigger, you have a better hope of breaking the shopping chain altogether. For instance, if you are stuck in a chair nursing your newborn multiple times a day with nothing but a phone, the trigger might be nursing or rocking your baby. A few ideas to break the habit chain in this instance:

- Don’t bring your phone to the rocking chair. In other words, remove the device used for the online shopping, or in the case of physical shopping, walk out of the store.

- Read a book. Using apps like Overdrive and Libby, you can borrow thousands of books for free with just a library card from your local library. They are downloadable and you can read them right there on your phone with the Amazon Kindle app.

- Write or journal. Use a notes app in your phone and write. Start a gratitude journal, make a lit of things you already own, or write about why you want to shop or whatever else is currently on your mind.

- If you are bored, pick up a new hobby that keeps your hands busy. I personally love crafts, puzzles, and, of course, reading.

Set financial goals.

Habits can help or hurt financial goals depending on what they are. Like my wedding example above, I find if I have really motivating long or short-term financial goals, I can keep my shopping addiction in check.

Set visual cues against buying stuff.

Setting visual cues to remind yourself of your goals to break a habit can be very helpful. A few ideas:

- Put a sticky note on your credit card reminding yourself of your desire to stop buying stuff

- Make a financial goal progress sheet, print it out and put it somewhere easily visible from whatever place you doing the most online shopping.

Move to a cash envelope system.

This is widely popular due to the recommendation from Dave Ramsey. If you think you can make a cash envelope system work for you, I recommend you give it a try. If you can only spend cash, you are forced to go to a store and there is nothing else you can do except stop buying stuff online.

Reduce your reasons to shop for stuff.

The primary motivation behind this idea is to auto subscribe to things you know you need and use. If you are auto subscribed to toilet paper and dish soap, you no longer need to shop for those items. This by default gives you less opportunities to overspend. Be careful with this and make sure you don’t auto subscribe to too much or too often.

The other thing to try here is a capsule wardrobe, which reduces the amount of clothes you need, and therefore reduces your need to shop for clothes.

Set up a “stop shopping” challenge.

If you are someone who loves a good challenge and are very competitive, this might be a good one for you. Don’t forget to track your results! Here’s a couple ideas:

- How long can you go without shopping?

- What can you use that you already have that would fulfill the need for whatever you are driven to purchase?

- Keep a running tally of everything you want to buy but don’t. See how high you can get the total amount saved in a given month.

Institute a pause.

Break up the habit chain. For this you need to create a new habit. Select a trigger (e.g. putting an item into your shopping cart) and create a habit to carry out one or more of several types of pauses:

- Make yourself wait a full 24 hours before you purchase. If you still have a burning desire for it, and you know you have the money/budget for it, at that point follow through with the purchase.

- Think it out: Do you have an immediate use for it? Do you know exactly where in your house you will put it? Pulling on Marie Kondo: Does it spark joy? Do you absolutely love it? Check out this post to help figure out if an expense is really worth it.

- Remember your goals. Pause to remember your financial goals. Trying to save for a down payment on a house? As I mentioned earlier, a $30 purchase may not seem like much right now, but over time, it adds up. Every dollar you spend is one you are not putting towards your goals. Over time this has a very real ability to delay your ability to reach your financial goals.

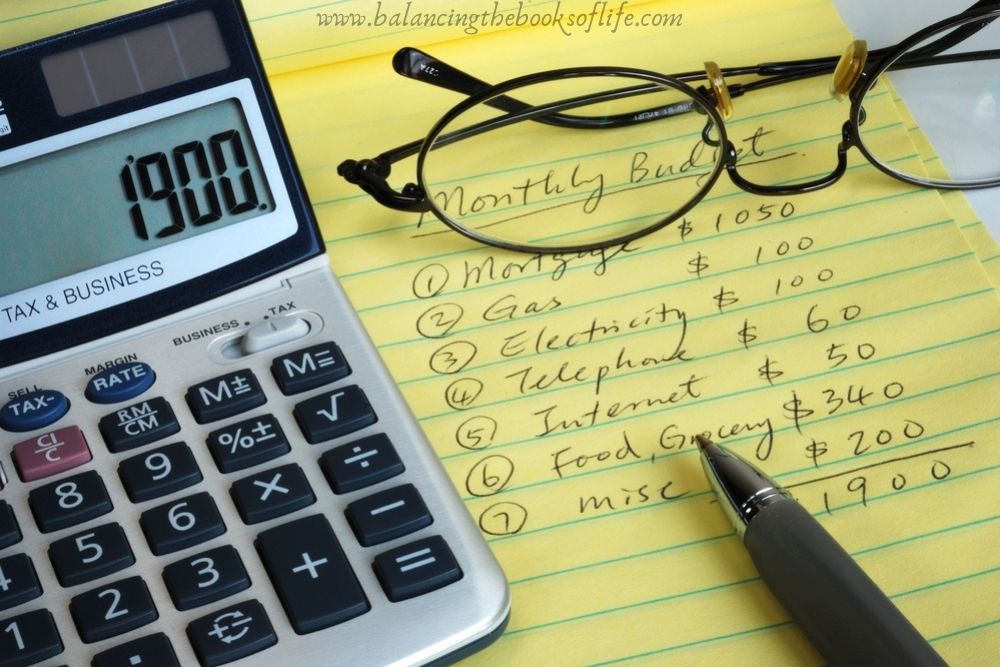

Stop buying stuff by creating a budget.

It’s important to have some idea of where the money in your account needs to be going. It doesn’t matter if your money is going towards bills that are necessary to keep a roof over your head and your lights on, or a savings account to allow you to go on that vacation or buy a car or a house. Knowing how much money you are making and a rough forecast for how it will be spent is crucial. This will tell you how much money you have for random impulse purchasing before you spend that money. Once you make the purchase, don’t forget to track the expense. You don’t necessarily need to stop buying stuff, but maybe just stop buying as much stuff. I recommend having some money allocated to impulse spending. Reducing your impulse purchasing slowly is a much easier approach to cutting it out cold turkey.

Understanding and intercepting the habit cycle of shopping is the key behind how to stop buying stuff online. In my own journey, I currently have a strong financial goal of adding dormers and replacing some windows in our house, and I really want to do that without taking on debt. That goal is the main driver behind my current ability to stop buying stuff. In addition, whenever I get the desire to shop, I try to focus instead on my project of de-cluttering our house. That way, instead of adding stuff to our house, I’m removing it.

While instituting just one of the ideas from this list can certainly help, I use a combination of many of these tips to avoid impulse buying, control my own desires and keep my habits in check. I recommend you give it a shot as well, and let me know how it goes!

Michele is the fun-loving, easy going, project managing, financial savvy author behind the Balancing the Books of Life blog. She invites other moms to come along her journey to both become financially independent and spend time on things they love!

Leave a Reply